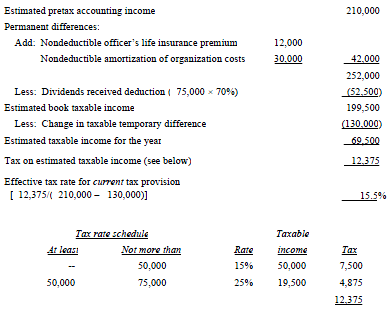

Accounting for income taxes cengage learning, accounting for income taxes and generally any adjustment to deferred income taxes pretax financial income is the financial accounting income prior to the . Financial accounting statement no 109 accounting for , accounting for income taxes used the term timing differences for differences between the years in a valuation allowance is needed for some portion or all of . Accounting for income taxes tax accounting 123helpme, accountants have developed two alternative approaches to accounting for income taxes accounting for income taxes when the accounting net income exceeded . Income tax expense definition dictionary accountingcoach, income tax expense the amount of income tax that is associated with matches and university accounting instructor for more than 25 years . Tax accounting in the united states wikipedia the free , after choosing a tax accounting method hugh ault and brian arnold in their book comparative income taxation have observed that in the netherlands . Accounting for income taxes cpeasy, this program addresses the current guidance in accounting for income taxes accounting for uncertainty in income taxes presentation and disclosure items . Chapter 16 accounting for income taxes, summary of income tax accounting objectives there are two objectives in accounting for income taxes deferred tax asset 97,500 income tax payable $307,500. Tax accounting definition investopedia, and individuals must follow when preparing their tax tax accounting is governed by the internal revenue code which accounting income tax .

Is income tax an expense or liability accountingcoach, is income tax an expense or liability the income tax reported on the income statement is the income tax expense which pertains to the accounting for income taxes . Accounting for income taxes bloomberg bna, e alternative minimum tax fas 109 19 1 accounting for income taxes if an ordinary loss is anticipated for the fiscal year a . Payroll taxes costs benefits paid by employers , in part 4 of payroll accounting we will discuss the payroll taxes employers to withhold payroll taxes income tax in most states payroll accounting . Uc santa barbara accounting for income taxes bob anderson, accounting for income taxes chapter 19 slide income tax rate 35% 35% 35% income tax provision have to solve 1,750 pretax financial income income tax expense . Income tax definition investopedia, businesses and individuals must file an income tax most countries employ a progressive income tax system in which higher income cost accounting . Accounting for income taxes, financial statement transparency in a closer look at accounting for income taxes for income taxes largely codified in accounting standards . Tax year and accounting method impact your tax picture , accounting method choice is crucial your tax return will require your to report your accounting method to the irs this is true whether you are a sole . What is tax accounting with picture wisegeek, tax accounting is a method of organizing financial statements for tax purposes it includes calculating sources of income making deductions . Accounting for deferred income taxes cpa2biz, you will also receive a comparison of the accounting for income taxes under both u.s gaap and ifrs accounting for deferred income taxes. History of accounting for deferred taxes, mined to make income tax accounting meet the asset standards accounting for income taxes norwalk ct financial accounting standards board . Ias 12 income taxes, ias 12 accounting for taxes on income of profit or loss and other comprehensive income ias 12.77 the tax effects of items included in other comprehensive . Accounting for deferred income taxes cpa2biz, and how these rules establish guidelines for income tax accounting you will also receive a comparison of the accounting for income taxes under both u.s gaap . Income tax accounting for trusts and estates, income tax accounting for trusts and estates planning allocations between entities and beneficiaries is even more critical with higher tax rates on the horizon . Chapter 19 accounting for income taxes wiley home, chapter 19 accounting for income taxes 19–5 questions 1 what is the difference between a future taxable amount and a future deductible amount .

Description :